There are means, motives and opportunities to allocate to Chinese futures

As is often the case, China is currently experiencing a hive of activity with significant consequences. This includes recent confirmation of Xi Jinping’s unprecedented third term as President at the 20th National Congress as well as China’s ongoing policy divergence from most of the world and their commitment to opening their capital markets. We strongly believe that many of these major events are particularly unique to China and will continue to be financially material to international investors amid a possible final farewell to their zero-COVID policy. The same international investors find themselves in an increasingly stagflationary environment with dwindling expected returns from traditional assets and are consequently seeking diversification. In order to make the most of recent significant Chinese developments, allocators outside of China seeking liquid alternatives need three things: the means, the motive, and the opportunity.

The means refers to the capability to trade in Chinese markets in the first place. In particular, it is the onshore Chinese futures markets which provide strong prospects for diversification. Aspect has successfully deployed systematic strategies in these markets since 2016. Regarding the motive, trading strategies applied to Chinese futures markets, able to exploit themes unique to China, have shown that they can generate strong returns that are highly diversifying to global traditional and alternative investments. Finally, opportunity refers to access to Chinese markets. Opportunities are growing as Chinese authorities accelerate their plans to open up access to direct trading by overseas investors, partly due to China’s ambitions to become a global commodities pricing power. Let us delve into the means, motive, and opportunities further.

1.The Means

Aspect is a pioneer in researching Chinese futures and has accumulated an in-depth understanding of Chinese market microstructure through direct experience. We recognise Chinese market uniqueness and adapt our systems accordingly. China recognises that rising productivity can be enabled by efficient futures markets enabling hedging and speculation, but this needs to be carefully balanced with market stability. Consequently, trading strategies in China need to adapt to trading restrictions, optimally use available capacity and allocate to markets in a cost-aware manner. Continual research and development into directionally agnostic China-focused systematic strategies have helped Aspect stay competitive in each of these areas. In addition, Aspect’s futures trading capability includes the capture of a blend of directional and cross-sectional effects over varied timeframes balanced by a suite of systematic risk controls and limits.

2. The Motive

China is the second largest economy in the world, yet the percentage of foreign investment ownership remains in single digits. This under-allocation is likely to change. Our previous 2021 paper, “Diversification: Made in China”, highlighted the diversification benefits of an allocation to China versus traditional equity, Chinese equity and alternative strategies applied to global futures markets. These benefits included low correlations, even amongst the same commodity, e.g. a corn futures contract in China was only 0.3 correlated with a US corn futures contract. This remains an attractive feature of allocating to Chinese futures but what are the major idiosyncratic drivers of divergence in 2023 and beyond?

The macroeconomic backdrop in China for now and the foreseeable future centres around three main points:

- China undershot their 2022 real GDP growth target of 5.5% and subsequent targets are likely to be a challenge to hit. In order to support slowing output, China’s policy has diverged from most of the world. Beijing appears fixed on easing monetary, fiscal and regulatory policy and many of these changes including internationalising their markets are likely to be here to stay.

- China’s housing sector is over 15% of GDP (spurred by urbanisation) but is at risk, amid weak demand and credit-distressed behemoth property developers. Expect authorities to keep trying to shore up the market.

- China’s drift away from being a manufacturing-led economy towards services and consumption endures but China’s strict COVID policies curtailed crucial domestic services and consumption activity. The anticipated reopening of the economy should unleash pent-up demand.

There are other unique secular trends in China such as waning birth rates, rapid urbanisation, and digitalisation as well as world leading household savings rates and patent applications. These should present potentially investable dynamics to international investors. Let’s assess how some prevalent themes might affect tradeable Chinese futures markets and create a motive for participating in these markets.

3. The Opportunity

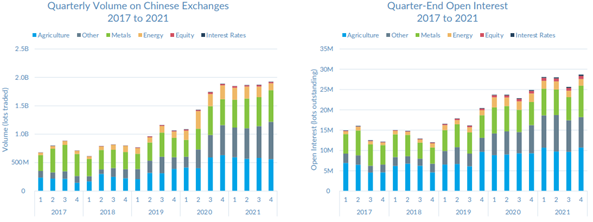

The chart above shows that over the past five full calendar years of available data, Chinese trading volumes have more than tripled and open interest has almost doubled. What is more interesting is that the opportunity for global investors to take advantage of surging liquidity is increasing.

China wants to amplify the use of the yuan across the planet, and seeks to become a global commodities pricing power, but both of these ambitions require significantly more international participation. It is for this reason that the nation has accelerated the opening up (internationalisation) of their derivatives market. In September 2022, China’s CSRC (China Securities Regulatory Commission) took final steps to approve trading of 23 futures markets for direct trading by overseas investors via the QFI (qualified foreign investment) regime. We expect more markets to follow.

These futures listed on Chinese exchanges include soybean, rapeseed, steel, silver and polyester futures. According to the Futures Industry Association, in 2021, soybean and rapeseed were the world’s top two traded agricultural futures whilst steel and silver were the top two traded metal futures.

Chinese authorities have regularly reiterated their commitment to opening up capital markets to overseas investors. Aspect has recently obtained a QFI license for more direct access to these markets, which will reduce trading costs significantly as compared to currently available access points.

4. Conclusion

The investment outlook in China is markedly different from much of the world and Aspect’s proven expertise in systematically trading Chinese futures makes it well placed to take advantage of increasing access to unique opportunities. At a time when the outlook for traditional investments is uncertain, an allocation to Chinese futures markets via directionally agnostic systematic strategies looks attractive from the perspectives of both pure return and potential diversification. China is too big to ignore and the means, motives and opportunities to act are here.

Disclaimer

Any opinions expressed are subject to change and should not be interpreted as investment advice or a recommendation. Any person making an investment in an Aspect Product must be able to bear the risks involved and should pay particular attention to the risk factors and conflicts of interests sections of each Aspect Product’s offering documents. No assurance can be given that any Aspect Product’s investment objective will be achieved. To view our disclaimers relevant to this article, please click here.